The Best Guide To Hsmb Advisory Llc

The Best Guide To Hsmb Advisory Llc

Blog Article

The Hsmb Advisory Llc PDFs

Table of ContentsExcitement About Hsmb Advisory LlcFacts About Hsmb Advisory Llc UncoveredHsmb Advisory Llc Can Be Fun For EveryoneHsmb Advisory Llc - TruthsNot known Factual Statements About Hsmb Advisory Llc Hsmb Advisory Llc Fundamentals Explained

Ford says to guide clear of "cash money worth or irreversible" life insurance policy, which is even more of an investment than an insurance coverage. "Those are extremely made complex, included high payments, and 9 out of 10 people do not require them. They're oversold because insurance representatives make the biggest commissions on these," he says.

Disability insurance coverage can be costly. And for those that decide for lasting care insurance, this plan may make disability insurance unneeded.

5 Simple Techniques For Hsmb Advisory Llc

If you have a chronic health issue, this kind of insurance might wind up being crucial (Life Insurance). Don't allow it worry you or your bank account early in lifeit's typically best to take out a plan in your 50s or 60s with the anticipation that you won't be utilizing it up until your 70s or later.

If you're a small-business owner, take into consideration safeguarding your livelihood by purchasing organization insurance policy. In the occasion of a disaster-related closure or period of restoring, service insurance coverage can cover your earnings loss. Take into consideration if a considerable weather event influenced your storefront or manufacturing facilityhow would that influence your revenue?

And also, making use of insurance policy can sometimes cost more than it conserves in the lengthy run. If you obtain a chip in your windshield, you may take into consideration covering the fixing expense with your emergency situation savings instead of your car insurance coverage. Health Insurance St Petersburg, FL.

10 Easy Facts About Hsmb Advisory Llc Described

Share these pointers to shield loved ones from being both underinsured and overinsuredand seek advice from a trusted professional when needed. (https://yoomark.com/content/httpswwwhsmbadvisorycom)

Insurance that is bought by an individual for single-person insurance coverage or insurance coverage of a family members. The private pays the costs, as opposed to employer-based wellness insurance where the employer often pays a share of the premium. People might go shopping for and purchase insurance coverage from any type of strategies readily available in the person's geographic area.

Individuals and households might receive monetary aid to decrease the expense of insurance coverage costs and out-of-pocket expenses, however just when registering via Attach for Health And Wellness Colorado. If you experience specific modifications in your life,, you are eligible for a 60-day period of time where you can sign up in a private strategy, also site web if it is outside of the yearly open enrollment duration of Nov.

Some Known Questions About Hsmb Advisory Llc.

- Connect for Wellness Colorado has a complete listing of these Qualifying Life Occasions. Reliant youngsters who are under age 26 are eligible to be included as household participants under a moms and dad's protection.

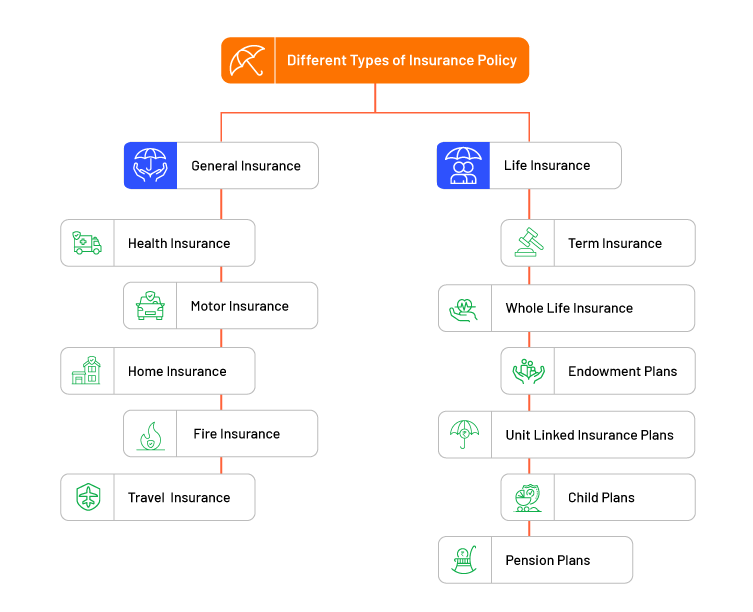

It might appear basic however comprehending insurance types can also be puzzling. Much of this complication originates from the insurance sector's continuous goal to design personalized protection for policyholders. In developing versatile policies, there are a range to choose fromand every one of those insurance coverage types can make it hard to comprehend what a details plan is and does.Little Known Facts About Hsmb Advisory Llc.

The very best place to begin is to speak regarding the difference between the 2 kinds of basic life insurance policy: term life insurance policy and long-term life insurance policy. Term life insurance policy is life insurance coverage that is only energetic temporarily period. If you die during this duration, the individual or people you have actually named as recipients may obtain the money payout of the plan.

Lots of term life insurance coverage policies let you convert them to a whole life insurance coverage policy, so you do not lose coverage. Typically, term life insurance policy plan premium repayments (what you pay per month or year into your plan) are not secured at the time of purchase, so every five or 10 years you possess the plan, your costs might rise.

They additionally have a tendency to be more affordable total than entire life, unless you get an entire life insurance plan when you're young. There are also a couple of variations on term life insurance policy. One, called team term life insurance policy, prevails amongst insurance choices you might have accessibility to with your company.Hsmb Advisory Llc Things To Know Before You Buy

Another variation that you may have access to via your employer is extra life insurance coverage., or funeral insuranceadditional protection that can help your family members in case something unforeseen happens to you.

Irreversible life insurance policy merely refers to any kind of life insurance policy plan that does not run out. There are numerous kinds of permanent life insurancethe most typical kinds being entire life insurance policy and global life insurance coverage. Whole life insurance policy is precisely what it seems like: life insurance coverage for your whole life that pays to your recipients when you pass away.

Report this page